Bank of America Apply Loan Online

Bank of America offers multiple loan options to its customers. There are various types of loans available for financing a house, a car or any other purchase. They have been discussed as follows

Fixed rate mortgages have a fixed monthly payment. The total monthly payment of the principal amount and the interest remains the same for the term of the loan. In case the interest rates rise in the future, you would be safe. Also, knowing that the amount of payment per month is fixed helps you plan your budget.

Adjustable –rate mortgages ( ARM’s) have an interest rate which changes periodically, according to the corresponding financial index which is associated with the loan. Bank of America also offers ‘Hybrid ARM’s’ which start of as fixed mortgages with a fixed interest for the initial period and after the expiry of that period the interest rate changes.

Jumbo Loans are those loans which exceed the high balance loan limits. The current loan limit for a single-family home is $417,000 for all states, except Hawaii and Alaska. These loans generally have higher interest rates, stricter underwriting, and larger down payments. They are available for primary residences, second or vacation homes and investment properties. They can be fixed rate or adjustable rate loans.

The Federal Housing Administration (FHA) and the U.S. Department of Veterans Affairs (VA) offer government-insured mortgage loans. These loans have features that may make them easier for first-time home buyers to obtain. They have low down payment options and flexible credit and income guidelines. They have no maximum income limitations. Fixed-rate loans are available and their maximum amount varies by country.

Refinancing your mortgage is a way to potentially lower your interest rate and monthly mortgage payment. You can switch to a fixed-rate refinance loan or use a portion of the available equity in your home to finance major expenses. The refinance loans can either be fixed rate or adjustable-rate. Refinancing your mortgage may increase the total number of monthly payments and/or the total amount paid when compared to your current situation.

A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line layer to use for large expenses or to consolidate higher-interest rate debt on other loans, such as credit cards. In addition to a HELOC often having a lower interest rate than some other common types of loans, the interest is usually tax-deductible. To qualify for a HELOC, you need to have available equity layer in your home, meaning that the amount you owe on your home must be less than the value of your home. Typically, you can borrow up to 85% of the value of your home minus the amount you owe.

Bank of America offers a quick 3 step application process for Auto Loans:

• Step 1: Apply online.

• Step 2: Get a decision

• Step 3: Get a call.

The car loan can be approved within minutes and you can get a call from the bank to further discuss your options.

Apply for a Bank of America Loan Online

Apply OnlineThe above link is for Home Loans and Lending Solutions which are offered by Bank of America. Click on Start Now and then click on Apply to start the loan application process.

You can also call 1 800 763 4820 for more details.

Bank of America Loan Calculator

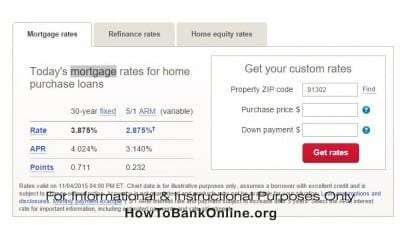

When you scroll down you can also check the mortgage rates by entering details such as Zip Code, Purchase price and Down Payment.

Updated on November 4, 2015